Saudi Arabia and Iran are rival Gulf powers that have long competed for influence in the Middle East. They have starkly different capabilities in manpower and materiel. Both have invested heavily in building modern militaries, partly because of their rivalry, even though neither seeks direct confrontation. Hostilities between the predominantly Sunni kingdom and the predominantly Shiite theocracy have usually played out through proxies, notably in Syria and Yemen.

Iran has a serious shortage of modern military equipment, largely due to sanctions and arms embargoes imposed after the 1979 Islamic Revolution. It has been forced to rely on arms from China and Russia. Out of necessity, Tehran has developed its own military industrial complex. Iran lacks modern tanks, warplanes, and naval warships but it has built a substantial arsenal of missiles.

Iran has a serious shortage of modern military equipment, largely due to sanctions and arms embargoes imposed after the 1979 Islamic Revolution. It has been forced to rely on arms from China and Russia. Out of necessity, Tehran has developed its own military industrial complex. Iran lacks modern tanks, warplanes, and naval warships but it has built a substantial arsenal of missiles.

Iran has also invested in developing unconventional warfare abilities—at home and with regional proxies—far more than Saudi Arabia has. Its influence is visible in Lebanon’s Hezbollah, Yemen’s Houthi rebels, Shiite militias in Syria and Iraq, and Palestinian Hamas and Islamic Jihad. Iran has exploited unrest in the region, deploying its forces and gaining valuable experience in unconventional wars. Iranian military advisors have advised, trained, armed, and gone into battle with some of the foreign militias.

In contrast, Saudi Arabia had the third largest defense budget in the world in 2017. It has increased its defense spending as regional tensions have escalated. Its official budget in 2017 reportedly totaled nearly $65 billion—almost $55 billion more than Iran’s budget. In 2018, Saudi Arabia spent some $67 billion on defense. Between 2014 and 2018, it was the world's largest arms importer.

Saudi Arabia has invested deeply in conventional military equipment and training. The kingdom is the number one importer of U.S. and British military goods. It has also benefited from the stationing of U.S. troops in the Gulf. But Saudi troops have been slow to learn how to use cutting-edge equipment, such as Patriot missile systems purchased from the United States. The military has also been plagued by rampant nepotism, skewing leadership appointments, despite Crown Prince Mohammed bin Salman’s pledge to crack down on corruption within the military. The Saudi Army is not well-prepared for offensive operations, which may be one reason it has relied on missile and air strikes rather than directly engaging its ground forces in Yemen.

The real strength of the Saudi military lies in the Royal Air Force. Riyadh has invested billions of dollars to project power over long distances. The Air Force proved its effectiveness by flying almost 100,000 sorties over Yemen between 2015 and 2018. By controlling the skies, Saudi Arabia could effectively control the battle space in a conventional war.

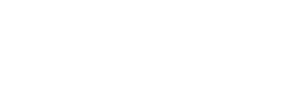

Manpower

Iran and Saudi Arabia have different types of forces. Iran’s military includes conventional ground, air and naval forces. It also has separate revolutionary forces, ranging from highly trained troops to poorly equipped volunteers.

In addition, Iran has built a large paramilitary. The Basij is an auxiliary force under the Islamic Revolutionary Guard Corps (IRGC). It is tasked largely with internal security. It has 90,000 active forces, according to the Center for Strategic and International Studies. But the Basij can mobilize up to 1 million. Iran also has smaller paramilitary units for border security and law enforcement. Iran has worked extensively with Shiite militia groups to extend its influence in the region.

Saudi Arabia has conventional ground, air and naval forces. Its paramilitary Border Guard—of roughly 10,500—operates separately under the Ministry of Interior. It also has a Coast Guard of 4,500 men, plus a Facilities Securities Force of 9,000 troops under the Ministry of Interior. The kingdom relies on its conventional forces and its partnership with the United States to protect its interests.

Source: “The Military Balance 2018” – The International Institute for Strategic Studies

Ground Forces

Iranian ground forces can be broken into two distinct forces—the Artesh, or conventional army, and the Islamic Revolutionary Guard Corps, a powerful military and economic player. The Artesh has 350,000 troops; 220,000 are conscripts. It relies on vintage Chinese and Russian materiel; it receives less funding than the IRGC. It lacks the ability to launch a major ground offensive. It has limited logistical capabilities for a major ground offensive, although it did deploy forces in Syria.

The IRGC, Iran’s premier fighting force, has 100,000 soldiers. It has the most advanced equipment and training. The IRGC has often taken the lead in confronting external threats, including during the 1980-88 war with Iraq and against Islamic State militants in Iraq and Syria between 2014 and 2018. Its paramilitary wing has played a role during internal unrest, notably the 2009 Green Movement uprising.

Saudi Arabia is vastly different in its land forces. It relies heavily on its alliance with the United States to deter adversaries; its army is 75,000 strong but lacks the capacity for a major offensive. The Saudi ground forces have yet to conduct ground operations in Yemen. Its campaign has relied largely on missiles and bombs. The Saudi Arabian National Guard is 100,000 strong and includes tribal levies. It is well-equipped, with Apache and Black Hawk helicopters and the largest light armored fleet in the world.

The two militaries differ most in leadership and fighting experience. Iran’s military is war-hardened. The IRGC’s elite Qods Force has operated—overtly and covertly—in Lebanon, Syria, Iraq, and Yemen. Many of its top commanders, such as Qods Force commander Qassem Soleimani, cut their teeth fighting Saddam Hussein’s army in Iraq. Saudi Arabia’s military commanders do not have comparable experience. Saudi Arabia has a small unproven army plagued by decades of nepotism.

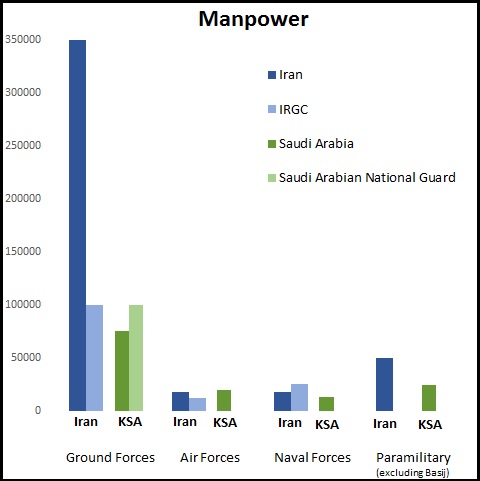

Air Force

The most important aspect of combat in the 21st century is maintaining air superiority. After years of sanctions, the Iranian Air Force has not been able to upgrade or even maintain its aging air corps. It relies on dated American F-4 and F-5 fighters (from the Vietnam War-era) as well as Russian MIG-29s and SU-25s, which are not comparable to advanced Saudi Air Force fighters. Iran tried but failed to develop a military aircraft industry. It developed the Qaher 313 fighter in 2013, but as of mid-2018 it had still failed to complete a test flight.

Saudi Arabia’s Royal Air Force relies on the latest Western warplanes, including F-15s. It has a distinct advantage over Iran. By mid-2018, Saudi Arabia had flown 100,000 sorties on Yemen. Saudi pilots now have significantly more combat experience than their Iranian rivals.

*The Saudi Arabia chart includes all helicopters across the country’s military, including the National Guard. Both charts exclude reconnaissance, training and other air planes.

Source: “The Military Balance 2018” – The International Institute for Strategic Studies

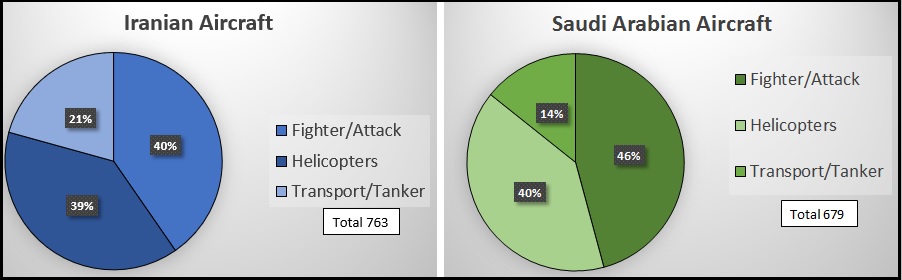

Missiles

Both Iran and Saudi Arabia have long-range surface-to-air missiles with ranges of more than 75 kilometers. But neither has long-range surface-to-surface missiles.

Saudi Arabia has worked with its Western allies to build a better missile defense, but poor coordination with neighboring Gulf states has limited its effectiveness. The kingdom has advanced Patriot missile systems for defense. Offensively, the Saudis have Chinese-built DF-3s and possibly DF-21s. The Saudi Air Defense Forces also have more than 400 Avenger point-defense missiles.

*Saudi Arabia reportedly bought Chinese DF-21 medium-range ballistic missiles in 2007 but the number is not known. These are not included in this graph.

Source: “The Military Balance 2018” – The International Institute for Strategic Studies

Naval Forces

Iran has large naval forces—in both the Artesh and the IRGC—in the Persian Gulf. They operate a total of 193 patrol boats along the coast and the strategic Strait of Hormuz. The IRGC operates 56 patrol boats. They have had occasional encounters with the U.S. Fifth Fleet in the Gulf, including the capture of U.S. sailors in 2016. Iran also has an aging submarine fleet of Soviet-era submarines and one domestically produced Fateh submarine that was still undergoing trials in mid-2018.

Saudi Arabia has a limited naval force that relies on the U.S. Fifth Fleet based in Bahrain. It has seven French-made frigates and destroyers. It also owns 30 patrol boats, a fraction of Iran’s fleet.

*All data sourced from “The Military Balance 2018” by The International Institute for Strategic Studies unless otherwise noted. See the full publication for more detailed information. The graphs represent the author’s interpretation of the data.

Thomas Neal is a West Point Cadet who interned at the U.S. Institute of Peace in 2018.